Sterling Investment Report #003

Portfolio Fitness: Can Investment Trust "Workouts" Boost Your Returns?

Persistent discounts plague many investment trusts. Enter the 'managed wind-down' – a decisive move to return capital. Can these 'Workouts' genuinely supercharge your portfolio or is it a lost cause? Let's explore.

Investment Trusts and Today's Pervasive Discounts

An investment trust is a publicly listed company that invests in a diversified portfolio of assets (equities, bonds, property, infrastructure, etc.), managed by a professional fund manager. Its shares trade on a stock exchange, where their price can diverge from the trust's Net Asset Value (NAV) per share. The total NAV represents the entire value of the trust's investments less its liabilities; this total, divided by the number of shares in issue, gives the NAV per share. When the share price is below the NAV per share, the trust's shares are said to trade at a discount. This theoretically allows investors to buy into the underlying assets for less than their market worth. Conversely, a premium means shares are more expensive than the underlying assets represented by the NAV per share.

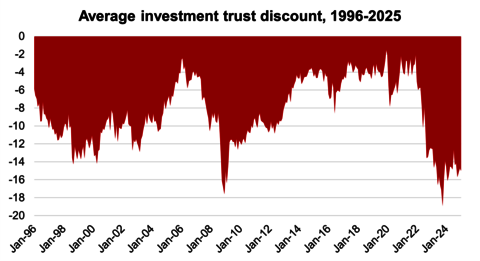

In recent years, discounts in the UK investment trust sector have notably widened across various strategies. This has often been attributed to factors like rising interest rates, economic uncertainty, and sector-specific challenges. While such discounts can frustrate existing holders, they may present opportunities for new investors and sometimes act as a catalyst for corporate actions. If persistent discounts are not addressed through other measures, such as share buybacks, boards may be compelled to consider more definitive solutions, often following a formal strategic review which can include exploring a managed wind-down.

The Managed Wind-Down Explained

A managed wind-down can occur when a trust faces persistent wide discounts, performance issues, or a strategic shift. This approach is increasingly common on the London Stock Exchange, especially for sub-scale trusts. These trusts typically grapple with:

Poor Liquidity: Low trading volumes hinder institutional investors and consolidating wealth managers from building or divesting positions without adverse price impact.

Higher Relative Costs: Fixed operating costs (listing, director, audit fees) form a larger part of a smaller NAV, leading to higher Ongoing Charge Ratios (OCRs) and reduced cost-competitiveness.

Lack of Investor Interest: Limited analyst coverage means smaller trusts can be overlooked, subduing share demand and widening discounts.

These factors frequently indicate that a trust is ripe for a strategic review. When challenges become entrenched, a wind-down becomes a viable path to return value to shareholders. The board ceases new investments, focusing on the orderly realisation of assets over a defined period. The board then uses the proceeds from these asset sales to distribute capital to shareholders, with the aim of reflecting the underlying asset value and thereby closing the discount to NAV.

A “Mental Model”: Wind-Downs as Buffett-esque "Workouts"

A managed wind-down fundamentally alters the investment. An ongoing investment trust resembles what Warren Buffett, during his Buffett Partnership era, termed a "General." In a wind-down, it transforms into a "Workout." These distinct categories, which we will explore in more detail later, carry different implications for investment analysis and expected returns. For now, understand that a "General's" value hinges on future earnings and manager skill, often moving with broader market tides, while a "Workout" derives its value primarily from the successful completion of a specific corporate event or process, largely independent of those broader market conditions.

The investment thesis shifts from future growth prospects to the asset realisation process and timeline. By selling assets and returning cash, a wind-down allows shareholders to realise the full value of their holdings. For trusts trading at a discount, this means realising a value closer to NAV, which is inherently higher than the pre-announcement market share price. This approach is characteristic of classic special situation investing. The returns are often driven by the "event" (the wind-down announcement and subsequent actions) rather than by broader market movements.

Key Factors and Inherent Risks Determining a Wind-Down's Success:

The potential success of such a wind-down hinges on several interconnected factors, each carrying inherent risks that investors must carefully evaluate. These are not "easy money" scenarios, and thorough due diligence is paramount:

Initial Discount vs. Asset Valuation Uncertainty: A compelling discount may be offset if the underlying assets, especially illiquid ones (such as unlisted infrastructure or private equity), fail to achieve their stated NAV upon sale due to market conditions or inherent valuation complexities.

Asset Liquidity and Execution Complexity: The ease of selling assets directly impacts the timeline and success, with execution risk heightened by illiquid holdings, complex disposals involving meticulous planning and stakeholder communication, potential regulatory hurdles, or unforeseen liabilities.

Wind-Down Timeframe and Potential Delays: An estimated timeline for realisation can be significantly extended by difficulties in selling assets, prolonged regulatory approvals, or adverse market conditions, locking up capital, incurring opportunity costs, and potentially diminishing the investment's internal rate of return (IRR).

Containment of Wind-Down Costs: Successful outcomes depend on managing the various costs of the wind-down (ongoing management, advisory, legal, and potential performance fees), as these directly erode the net proceeds available to shareholders.

Board/Manager Credibility, Alignment, and Incentives: The experience of the board and manager is vital, but success also depends on their incentives being strongly aligned with maximising shareholder value swiftly and effectively throughout the realisation process, avoiding potential conflicts of interest.

The Potential for Uncorrelated Returns from "Workouts"

Despite these risks, special situations like managed wind-downs ("Workouts") offer returns potentially less correlated with the general stock market. While market sentiment can influence asset sale prices, the successful execution of the wind-down plan, navigating the risks outlined above, is the primary return driver.

This can be a valuable portfolio diversifier. During his Buffett Partnership days, Warren Buffett categorised his investments into distinct groups, each offering different risk and return profiles:

"Generals": These typically involved securities identified as undervalued based on quantitative metrics, although qualitative aspects also played a role. Profitability from "Generals" depended on the market eventually recognizing this undervaluation or on improvements within the underlying business. These often formed a substantial part of the partnership's portfolio.

"Workouts" (Special Situations): The financial outcome of these investments was primarily contingent upon specific, usually pre-announced, corporate actions—such as liquidations, mergers, or reorganisations—rather than general market movements. Managed wind-downs align closely with this category.

"Controls": In these instances, the partnership acquired a controlling interest, or a stake sufficient to influence corporate policy. The objective was often to unlock value that the market had failed to recognize, and "Control" situations could evolve from "Generals" that remained undervalued for extended periods.

Allocating to "Workouts" can provide returns that behave differently from "Generals," potentially smoothing overall portfolio volatility and offering opportunities even in flat or declining markets. Their success is tied to specific corporate actions, not just macroeconomic trends, making them a strategic choice for investors looking to achieve particular portfolio 'fitness' objectives, such as enhanced diversification or capturing value independent of broad market sentiment.

Understanding these dynamics is one thing; seeing them in practice is another. Let's examine a few current examples of investment trusts undergoing managed wind-downs.

Abrdn European Logistics Income plc (ASLI): [SP: 59p, MC: £242m] (Q1 2025 IFRS NAV: 70.6p)

Strategy & Assets

ASLI is a closed-end fund owning 'mid-box' European logistics sites. Its portfolio is concentrated in Spain, Netherlands, France, and Germany, featuring high-quality tenants like Amazon, DHL, and Dachser.

Progression & Considerations (as of Q1 2025 Update)

The company is actively progressing with its orderly asset realisation strategy. In Q1 2025, ASLI returned €19.7 million (equivalent to 4.8c or 4.0p per share) to shareholders. Excluding this distribution, the IFRS NAV per share (ex-liquidation costs) rose 1.1% to 87.0c (72.7p). Including the distribution and a full provision for estimated liquidation costs, the IFRS NAV stood at 84.5c (70.6p). The like-for-like portfolio valuation (excluding recently sold Spanish assets) increased by 0.8% (€4.3 million) during the quarter.

Successful disposals at or above book value are encouraging signs: two Spanish assets (Barcelona, Coslada) were sold in January 2025 for €29.7 million, an 11.9% premium to their Q3 2024 valuations, with €17.7 million of the proceeds used for debt repayment. The sale of a warehouse in Oss, Netherlands, also completed for €15.7 million (in line with valuation), and €9.9 million of debt was repaid (transaction completed late Dec 2024, announced Jan 2025). Currently, ASLI is under offer for five assets (approximately 120,000 sqm), with contracts anticipated in the coming weeks, potentially enabling a further capital distribution by mid-Q3 2025. Three additional assets (c.90,000 sqm) are in detailed due diligence, and others are being marketed.

Key considerations for investors include the steady execution progress demonstrated in the Q1 update, with capital returned alongside an underlying NAV increase. Financially, the Loan to Value (LTV) ratio was a moderate 36.2% at the quarter-end, and the trust benefits from aggregate fixed debt facilities of €218 million at an attractive average all-in interest rate of 1.93%, with the earliest debt maturity in mid-2025, providing a stable financial footing. Operationally, leasing success continued, exemplified by a new 7-year lease at Getafe, Madrid, which reduced the void rate to 2.6%, and rent collection remained robust at 99.6% for Q1 2025. Upcoming catalysts include future disposals, particularly the five assets currently under offer, and the anticipated further capital return in Q3 2025.

Aquila European Renewables plc (AERS) [SP: 55p, MC: £210M] (As of March 31, 2025, NAV: 83.95 cents, note EUR/GBP)

Strategy & Assets

AERS invested in a diversified portfolio of renewable energy infrastructure projects, including wind, solar, and hydro assets, across Europe.

Progression & Considerations (as of March 31, 2025 / Q1 2025 Update)

The company appointed Rothschild & Co as its financial adviser to oversee the wind-down. As of March 31, 2025, the NAV was €317.4 million, or 83.95 cents per share. The Q1 2025 NAV total return was 0.1%, impacted by an increase in the portfolio discount rate to 7.5% (due to higher risk-free rates), although European power price curves remained stable during the period.

Regarding asset disposal, on May 1, 2025, AERS announced an agreement to sell its 18% interest in the Sagres Portuguese hydropower asset at a valuation in line with its December 31, 2024 NAV. The board is targeting the broader wind-down through two discrete portfolio disposals: a majority of the portfolio (for which non-binding Heads of Terms have been agreed and exclusivity granted to a preferred bidder, with an update anticipated by end of June 2025) and a portfolio of assets in a single geography (via a simultaneous focused sale process). The board's objective is to complete the sales process as quickly as possible, providing liquidity to shareholders at a premium to the prevailing share price by realising assets close to their reported NAV.

For investors, key factors influencing returns will be the prices achieved for the renewable energy assets, which can be affected by power price forecasts, discount rates, and regulatory environments. While the Sagres disposal aligned with NAV, the company cautions that uncertain renewable market conditions mean there is no guarantee of similar outcomes for the remaining portfolio, introducing execution certainty as a key consideration. The timeline for the two main portfolio disposals and subsequent capital returns will be critical to monitor.

Digital 9 Infrastructure plc (DGI9) [SP: 8.5p, MC: £72M] (As of December 31, 2024, NAV: 34.4p)

Strategy & Assets

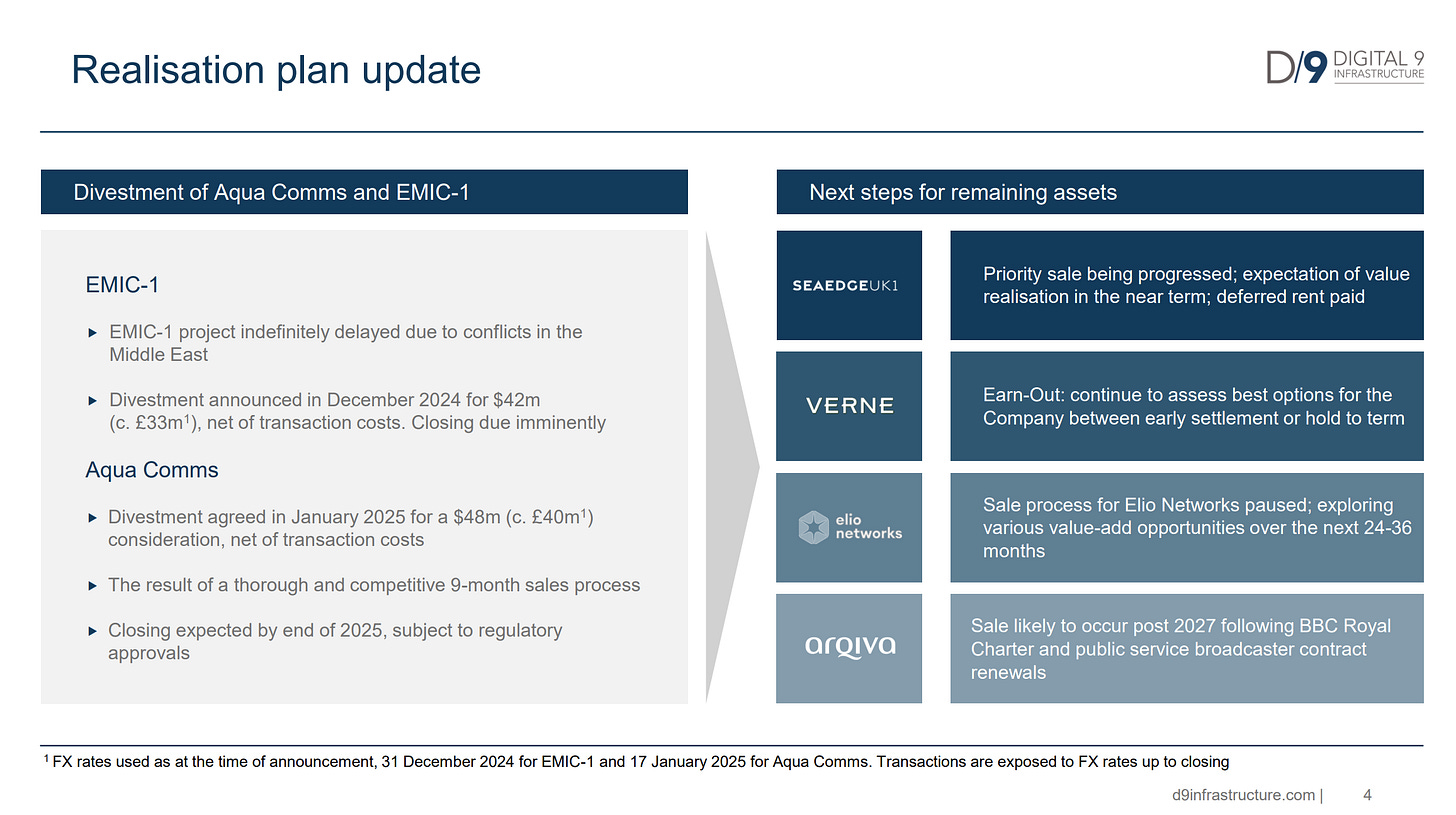

DGI9 invested in a range of digital infrastructure assets, including subsea fibre (Aqua Comms, EMIC-1), data centres (Verne Global - now sold, SeaEdge UK1), terrestrial fibre, and wireless networks (Elio Networks), as well as a significant stake in Arqiva Group (UK broadcast and communications infrastructure).

Progression & Considerations (as of year-end 2024 & recent updates)

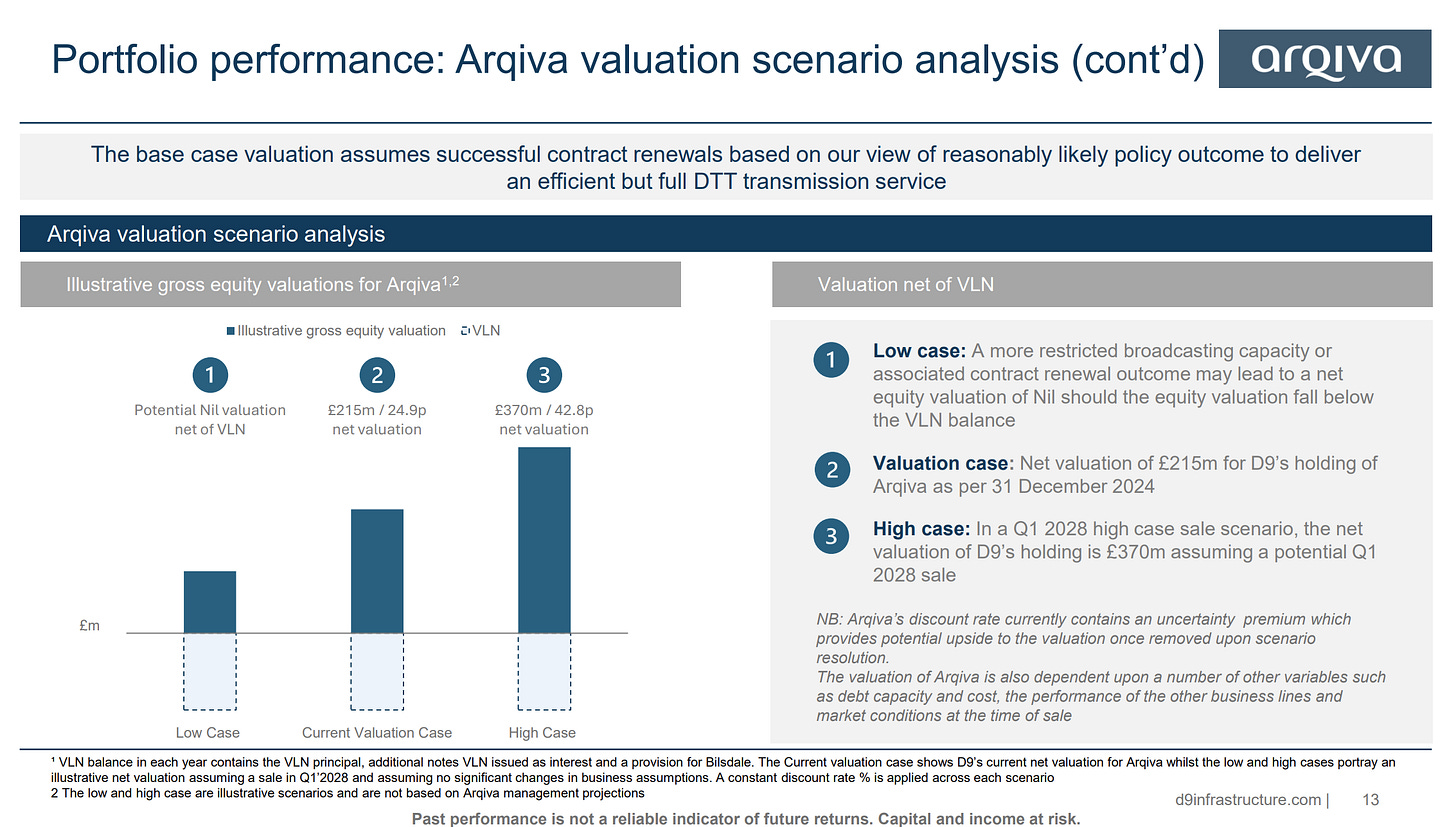

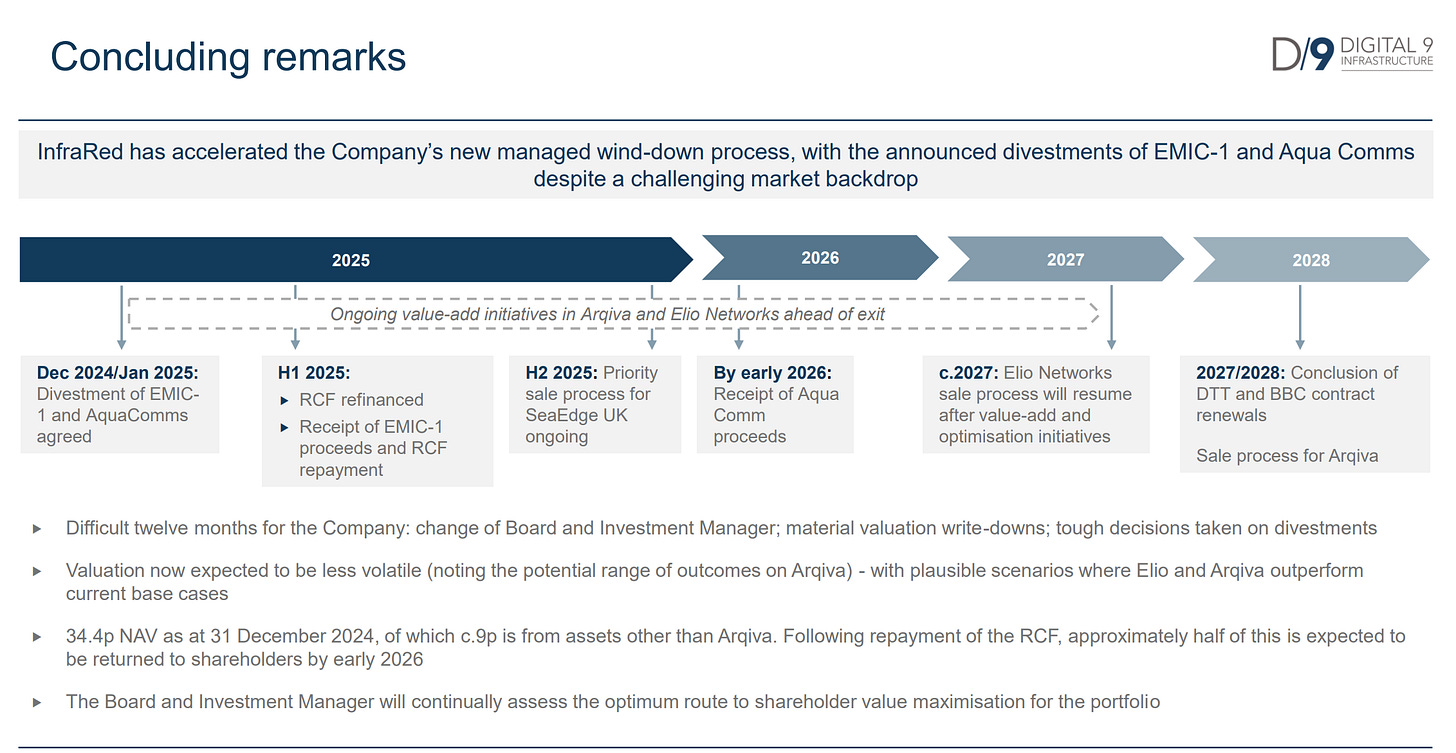

The company is navigating a complex managed wind-down, now overseen by new investment manager InfraRed Capital Partners (appointed October 2024, effective December 2024). The immediate focus is on asset disposals to repay its Revolving Credit Facility (RCF) and subsequently return capital to shareholders. The 2024 full-year results revealed a dramatic 56.7% decrease in NAV to £297.3 million (34.4p per share) as of December 31, 2024, mainly due to adjustments for the agreed sale considerations for Aqua Comms and EMIC-1 (prior to the final EMIC-1 completion) and a substantial revaluation of Arqiva.

The sale of Verne Global completed in March 2024, yielding £347m net proceeds used to pay down the RCF (a potential earn-out is still being valued). More recently, on May 29, 2025, DGI9 announced the completion of the EMIC-1 divestment for a final net consideration of US$43m (c. £32m). These proceeds, along with the release of $10m in construction commitments, will facilitate an imminent £40m repayment of the RCF. A binding sale agreement remains in place for Aqua Comms for $48m (c.£40m) net, though completion faces lengthy (c.12 months) regulatory approvals. The divestment process for SeaEdge UK1 is reported as "progressing well," with realisation expected "in the near term," while the sale process for Elio Networks is paused as InfraRed undertakes "value-add initiatives", extending its exit timeline. The Arqiva Group stake, considered the most significant remaining asset, is not expected to be sold before 2027. Clarity on key broadcasting contract renewals is essential, as these will significantly influence where Arqiva's valuation falls within a notably wide range of potential outcomes.

Following the EMIC-1 proceeds, the RCF balance will reduce to £13m. The original RCF (c.£53m balance prior to the EMIC-1 proceeds) was refinanced post-year-end 2024, with a new three-month term expiring June 16, 2025 (with extension options). The remaining £13m is anticipated to be repaid from further divestment proceeds and working capital surpluses.

Key investor considerations centre on several critical risks and progress markers. Execution risk is paramount: InfraRed’s ability to finalize remaining disposals like Aqua Comms and SeaEdge UK1 is crucial for full RCF repayment and subsequent capital returns. The Arqiva stake remains a major variable; its extended sale timeline (post-2027) and dependence on contract renewals contribute to significant uncertainty, a risk already highlighted by its substantial 2024 NAV write-down. Beyond Arqiva, valuation and governance issues persist, including an independent review of prior-year valuations (which could lead to historical adjustments), ongoing negotiations with the former manager (Triple Point) over termination, and DGI9's pursuit of reimbursement for a subsidiary's loss ($2.8M) due to external fraud.

Overall, DGI9 is a deep special situation. While its pronounced share price discount reflects these substantial risks, the recent EMIC-1 sale completion and significant RCF paydown are tangible positive steps. Further opportunities for value realization will largely depend on InfraRed's continued effective execution against their wind-down plan, a visual overview of which is provided in the timeline below.

Beyond these detailed examples, numerous other UK-listed investment trusts are also navigating managed wind-downs, including names such as Abrdn Diversified Income and Growth plc (ADIG), Ecofin U.S. Renewables Infrastructure Trust (RNEW), and GCP Asset Backed Income Fund Ltd (GABI), among others. For investors equipped with a thorough understanding of the mechanics and a diligent approach to assessing the inherent risks, these "Workout" scenarios may indeed offer a distinct pathway to unlocking value.

Disclaimers

The information provided in this article regarding specific investment trusts is based on publicly available data as of late May 2025. The situations for these trusts can change rapidly, and the examples provided are not exhaustive. This article is for informational purposes only and does not constitute financial advice. Readers should conduct their own thorough due diligence before making any investment decisions. Please also refer to the full disclaimer available on the 'About' page, which applies to all content published here.